You can find any business articles, publications by keywords

My name is Alex Fit. I am a web specialist with over 15 years of solid professional experience. My area of expertise includes everything from website development, maintenance and support to the effective website promotion and advertisement.

Why should you choose me?

Popular Stories

Estate Planning for New Parents & Couples!

Every year there are millions of births recorded in the U.S. While becoming a parent is among the biggest joy of your life, it brings

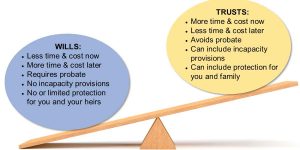

Estate Planning: Living Trusts vs. Will Difference & Importance!

No one wants to think about their death but it is something that no one can escape, however, it is necessary to assure you that your estate and family are safeguarded when you will not be around to secure them. While thinking to do so you can think of creating either a will or a trust. While the former completely emphasizes the dispensation of your belongings after you die, the latter emphasizes the management of the assets before and after your demise. Depending on your estate’s value and your family situation, you can opt for either a will or a trust or both. In order to make you understand them, we have summarized what they are and the factors to

How to do Estate Planning for Digital Assets?

With the evolution of technology, we all are living in a digital world with most of the works being done online. We have our business and personal data stored online. We are so much dependent on the online platforms that we ourselves don’t realize the value of the digital records and the loss that we would face if these assets are ever lost or become inaccessible. Thus, the digital assets have become an important kind of property that needs to be taken care of as well and must be included in our estate planning. If not done, your loved ones might face a lot of discomforts, unnecessary burden, and cost with the possibility of the estate lost. Estate Planning For

The Power Struggle: Can Trusts Override Beneficiaries

The Interplay Between Trusts and Beneficiaries: Exploring Their Relationship Overview Trusts serve as valuable tools in estate planning, enabling individuals to safeguard and oversee their assets during their lifetime and beyond. A common query that arises in the realm of trusts is whether they take precedence over beneficiaries. This article delves into the intricate relationship between trusts and beneficiaries, shedding light on their interaction and the balance of power between them. Understanding Trusts and Beneficiaries A trust constitutes a legal agreement wherein a trustee holds assets on behalf of beneficiaries. The trustee is entrusted with the responsibility to manage the assets within the trust for the benefit of the beneficiaries in accordance with the stipulations outlined in the trust document.

Estate Planning for Minors: What to Know

Young individuals with kids are generally in the initial stages of their lives and careers. Thus, they might not have something larger to be affected by taxes if they happen to die by chance. However, there are several non-tax reasons why estate planning for minors is essential. Estate plans are powers of attorney, or wills, or advance medical directives designating how the makers or the testators will allocate their assets after they are no more. Most of the time, married people leave their assets to each other with the hope that the surviving partner will make use of the inherited estate for providing for and caring for surviving children. But if both the parents die one after the other leaving

Generosity Made Simple: How to Gift a Large Sum of Money to Your Family

In the modern era, many families are considering giving a substantial amount of money to their relatives for various reasons such as inheritance, financial support, or simply out of generosity. This act can serve as a valuable way to assist family members in need and show love and care towards them. However, the process of gifting a large sum of money to family members can be overwhelming and intricate. It involves taking into consideration factors like tax implications and legal aspects. This article delves into the different facets of gifting significant amounts of money to family members, including the advantages, practical suggestions, real-life examples, and personal accounts. Advantages of Gifting a Large Sum of Money to Family There are numerous